Understanding how to calculate the Annual Percentage Yield (APY) and how it impacts your interest rates is essential for making informed financial decisions. APY provides a clear picture of the real rate of return on your investments or savings, considering the effects of compounding interest. This guide will help you understand APY and teach you how to calculate it accurately.

What is APY?

APY stands for Annual Percentage Yield. It reflects the actual interest earned on an investment or savings account in one year, considering the effect of compounding interest. Unlike simple interest, which is calculated only on the principal amount, APY includes interest earned on both the initial principal and the accumulated interest from previous periods.

Why is APY Important?

- Accurate Comparison: APY allows for a more accurate comparison between different investment and savings options.

- True Earnings: It gives a clearer picture of your actual earnings from an interest-bearing account.

- Compounding Effect: Shows the benefit of earning interest on your interest.

How to Calculate APY

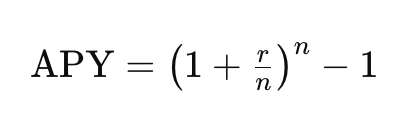

To calculate APY, you can use the following formula:

Where:

- r = nominal interest rate (annual interest rate)

- 𝑛 = number of compounding periods per year

Step-by-Step Calculation

- Determine the Nominal Interest Rate (r)

- This is usually provided by the financial institution (e.g., 5% per year).

- Identify the Number of Compounding Periods (n)

- Common compounding periods include annually (1), semiannually (2), quarterly (4), monthly (12), daily (365).

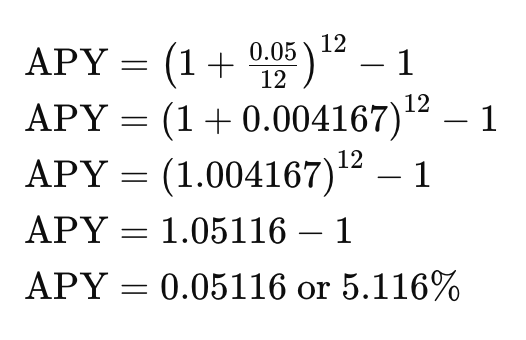

- Apply the Formula

For example, if you have an annual interest rate of 5% (0.05) compounded monthly (12 times a year):

Understanding Interest Rates

Interest rates can be categorized into two types:

1. Nominal Interest Rate

- The stated interest rate on a loan or investment without taking compounding into account.

- It’s the rate typically advertised by financial institutions.

2. Effective Interest Rate (APY)

- Takes compounding into account, providing a more accurate reflection of your earnings or cost.

- Generally higher than the nominal rate due to the effect of compounding.

Comparing APY with APR

It’s crucial to distinguish between APY and APR (Annual Percentage Rate):

- APY: Reflects the actual return on investments, considering compounding.

- APR: Reflects the annual cost of borrowing money, including fees and additional costs but not compounding.

Conclusion

Understanding and calculating APY is vital for evaluating the true return on your investments and savings. By knowing how to compute APY, you can make more informed financial decisions and compare different financial products more effectively. Always consider both the nominal interest rate and the compounding frequency to get an accurate picture of your potential earnings.

FAQs

1. What is the difference between APY and APR?

APY includes the effects of compounding interest, while APR does not and is used to represent the cost of borrowing money. Check our full article here.

2. How often should interest be compounded to maximize APY?

The more frequently interest is compounded, the higher the APY. Daily compounding will yield the highest APY compared to monthly or annually.

3. Can APY be lower than the nominal interest rate?

No, APY will always be equal to or higher than the nominal interest rate because it accounts for compounding interest.